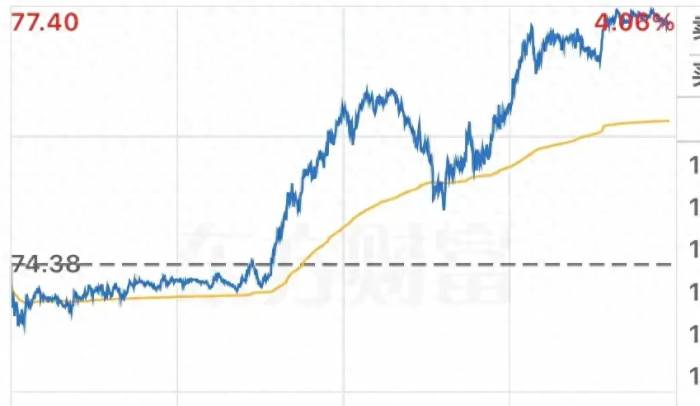

The recent strong rebound in the crude oil market has indeed shattered many people's expectations. Who would have thought that a market, which was considered to have slid into a "bear den" over the past year, could surge by 14% in just seven days? Crude oil, which was previously enveloped in a pessimistic mood, suddenly seemed to come back to life, not only reclaiming lost ground but also making many people start to doubt: Is it really not a dream to rise to $85?

However, it's important to remember that the market is never easy to predict. Last year, when crude oil fell from $92 to over $70, everyone was resolutely convinced that the bear market was here to stay. But now? The force of this rebound has slapped those expectations in the face. In fact, investing is like this; you never know where the next turning point will be.

The "low open, high walk" of this crude oil is a textbook case of a "face change" market. After one or two lifts, it ended up with a significant increase of 3.86%, which really caught the bears off guard. Now the question arises - how far can this rebound go? $85? Is it possible?

However, when it comes to market contrasts, the U.S. stock market has given us a rather unfriendly comparison. While crude oil is soaring, the U.S. stock market seems to have caught a cold. The Nasdaq, S&P 500, and Dow Jones are all green, falling in a very uniform manner.

There was no particularly bearish news, and the market fell like this, which is honestly a bit "perplexing." Especially in some popular sectors, such as artificial intelligence and digital currencies, the falls are heartbreaking. On the contrary, emerging technology sectors like lithium batteries and lidar have given the market some comfort, and their upward movements are quite eye-catching.

Let's take a look at the Chinese concept stocks. Last night was really a roller coaster ride, starting high and ending low, at one point falling so fast it made your heart race, but then at the end of the day, there was a counterattack, and it ended up closing up by 0.33%. The bottom-fishing funds were not idle this time, especially in some individual companies, like Financial One Account, which soared by 52.77%, a number that seems to be pumped up with adrenaline.

Companies like Xiaoniu Electric, Li Auto, and Baidu were also not idle, with their gains being quite pleasing. However, internet entertainment companies like Bilibili and iQIYI are a bit "miserable," falling by 1% to 4%, making people sigh that it's not easy to make money in the entertainment industry!

Yesterday, before the A-share market opened, a wave of "positive energy" was suddenly conveyed: international banks such as Goldman Sachs, UBS, and Morgan Stanley all expressed optimism about China's economic prospects. This scene is like foreign investment banks lining up to cheer, as if saying: "The Chinese market is fine, A-shares and Hong Kong stocks are very stable!" So, can this force really drive the market to continue to strengthen?

Looking at the heavy entry of foreign capital, at least in the short term, there is hope. Moreover, those who previously shorted A-shares are now howling with losses, and it is estimated that they will not dare to act recklessly again. Instead, going long seems to be a wiser choice.

Speaking of this, we can't help but ask: How long will the rebound in crude oil last? Will the downturn in the U.S. stock market rebound? How bright is the prospect of China's capital market? Perhaps the market is always full of surprises, but one thing is certain - at any time, do not draw conclusions lightly until the last moment. So, the editor-in-chief wants to ask in the end: In this unpredictable market, who is the ultimate winner? What do you think about this?